[ad_1]

The worldwide chip scarcity will proceed, and customers should pay for it, an analyst from the Worldwide Information Company stated.

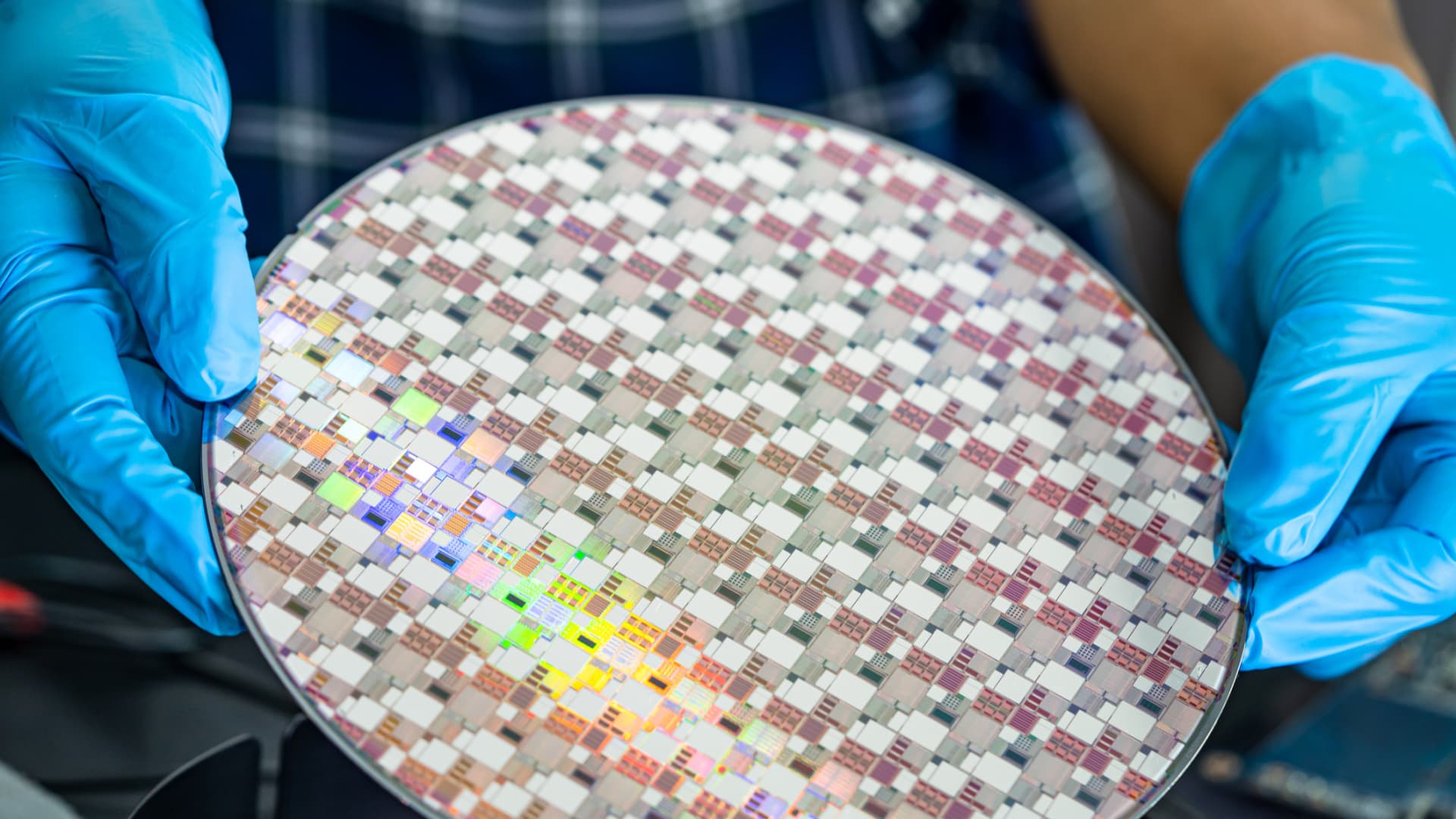

Sasirin Pamai | Istock | Getty Photographs

The worldwide chip scarcity shouldn’t be over but, and the warfare in Ukraine continues to place a pressure on provides of vital components wanted, one analyst advised CNBC Tuesday.

“The semiconductor provide shouldn’t be going to extend instantly. There are lots of uncooked supplies, gases, which had been required for manufacturing of these semiconductors,” Vinay Gupta, the Worldwide Information Company’s Asia-Pacific analysis director advised CNBC’s “Squawk Field Asia.”

Citing provide chain challenges because of Russia’s warfare in Ukraine, Gupta stated the 2 international locations seize a big a part of the market share, with Russia and Ukraine being the biggest exporters of krypton — a fuel used within the chip manufacturing.

Neon can also be essential for the chipmaking course of and is used for lasers, often called lithography, the place machines carve patterns onto tiny items of silicon made by the likes of Samsung, Intel and TSMC.

Greater than half of the world’s neon is produced by a handful of firms in Ukraine, in keeping with Peter Hanbury, a semiconductor analyst at analysis agency Bain & Co.

Semiconductors are utilized in the whole lot, from cell phones and computer systems to automobiles in addition to house home equipment.

Provide chain disruptions and rising prices may even imply “the typical promoting worth of the units goes to rise and the infrastructure distributors can be then passing it all the way down to the purchasers,” Gupta added.

‘Indicators of recession’ for shopper spending

Rising inflation and expectations of extra financial tightening are already inflicting a “consumer-led slowdown,” stated Gupta.

“IT spending, particularly shopper IT spending, is exhibiting indicators of recession.”

Whereas spending on enterprise IT — which incorporates software program providers, cloud and IT providers — are nonetheless holding out, inflation has pushed companies to “defend their IT budgets proper now.”

Coupled with rising rates of interest all all over the world, this slowdown is “going to chunk,” he added.

“However the hopes are that this will probably be a shallow slowdown, as a result of the federal government and central banks try to stability the rising inflation and … rates of interest,” Gupta added.

Final week, statements from two officers indicated the Federal Reserve is on its strategy to one other sharp rate of interest hike in July and maybe in September as properly, even when it slows the financial system.

In June, the Fed permitted a 75 foundation level, or 0.75 share level, enhance to its benchmark borrowing fee, the largest such transfer since 1994.

Sluggish hiring, much less spending in Asia

On Tuesday, Bloomberg reported Apple’s plans to sluggish hiring and spending on progress subsequent yr to cope with a doable downturn. A “comparable development” will probably be noticed throughout Asia’s tech sector, stated Gupta.

“I imagine that may be a development which we’ll begin seeing [in] late 2022 or early 2023 if the scenario doesn’t enhance.”

“If we discuss in regards to the IT providers in Asia, most of them are feeling margin pressures due to growing wage prices and ability gaps … available in the market.”

In India, for instance, the margins for the tech giants are “a bit decrease, regardless of extra hiring within the first-quarter, Gupta added. However this may occasionally not final lengthy.

“A number of enterprises had been shifting in the direction of new digital applied sciences due to the pandemic, enabling their workers working from house, so [there were] lots of new digital transformation tasks,” he stated.

“However we’ll begin seeing some margin pressures as a result of clearly the earnings of the enterprises will take a success, if we see the complete situation taking part in out such as you’re seeing it proper now.”

[ad_2]

Source link