[ad_1]

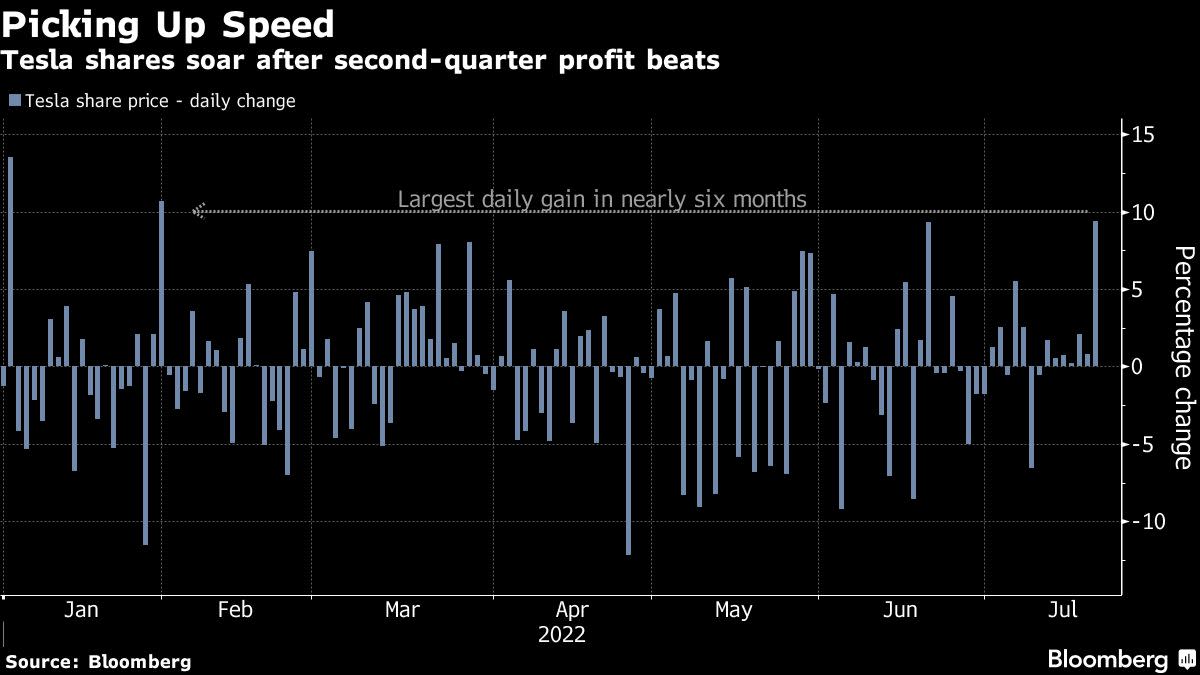

(Bloomberg) — The ten% surge in Tesla Inc. shares Thursday after the electric-vehicle maker reported sturdy earnings is creating one notable group of losers: The pile of merchants betting towards the inventory.

Most Learn from Bloomberg

Tesla is essentially the most shorted inventory on this planet, with nearly 3% of its float held in short-selling positions. S3 Companions estimates that these buyers are taking in additional than $1 billion in mark-to-market losses simply on Thursday’s surge. That drives their losses this month to $2.67 billion, in keeping with S3.

“Tesla quick sellers had been actively trimming their publicity forward of the earnings launch, masking 2.09 million shares, price $1.55 billion, during the last 30 days,” S3’s managing director of predictive analytics Ihor Dusaniwsky wrote in a word. Quick sellers may proceed to get squeezed out of their positions attributable to such “giant and sudden losses,” he wrote.

Shares of the Elon Musk-led firm wrapped up a seven-day profitable streak to shut at $815.12 in New York, the very best degree since Could 6.

In fact, none of this diminishes the sturdy 12 months Tesla shorts have loved to date, racking up $6.34 billion in mark-to-market earnings in 2022.

The reason being no shock. Tesla is within the midst of a troubled 12 months as the corporate battles supply-chain troubles and hovering raw-material prices. It was compelled to sort out manufacturing disruptions in China attributable to Covid-related lockdowns. Then there’s Musk’s ill-fated pursuit of social-media firm Twitter Inc., which weighed additional on investor sentiment.

Nevertheless, Tesla’s second-quarter outcomes after the market closed on Wednesday helped allay lots of these considerations. The corporate stood by its manufacturing outlook for the 12 months and stated demand was not an issue.

(Updates to shut costs in)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.

[ad_2]

Source link