[ad_1]

Apple is utilizing the iPhone’s reputation to push itself into the auto trade. Automakers are a little bit uncertain how they really feel about this.

Apple introduced the following technology of its automotive software program CarPlay in June. It takes over the person interface on all inside screens, changing fuel gauges and pace dials with a digital model powered by the driving force’s iPhone. It advised CarPlay helps automakers promote automobiles.

Apple engineering supervisor Emily Schubert mentioned 98% of latest automobiles within the U.S. include CarPlay put in. She delivered a stunning stat: 79% of U.S. consumers would solely purchase a automotive if it supported CarPlay.

“It is a must-have characteristic when searching for a brand new automobile,” Schubert mentioned throughout a presentation of the brand new options.

The auto trade faces an unappealing selection: Provide CarPlay and quit potential income and the prospect to journey a significant trade shift, or spend closely to develop their very own infotainment software program and cater to an probably shrinking viewers of automotive consumers who will buy a brand new automobile with out CarPlay.

Apple desires a seat on the desk

Carmakers promote further providers and options to automobile homeowners on an everyday, recurring foundation as automobiles connect with the web, acquire self-driving options, and transfer from being powered by gasoline to powered by electrical energy and batteries.

The automotive software program market will develop 9% per 12 months by means of 2030, sooner than the general auto trade, in response to a McKinsey report. Automotive software program may account for $50 billion in gross sales by 2030, McKinsey analysts predict.

Apple desires a chunk of the pie.

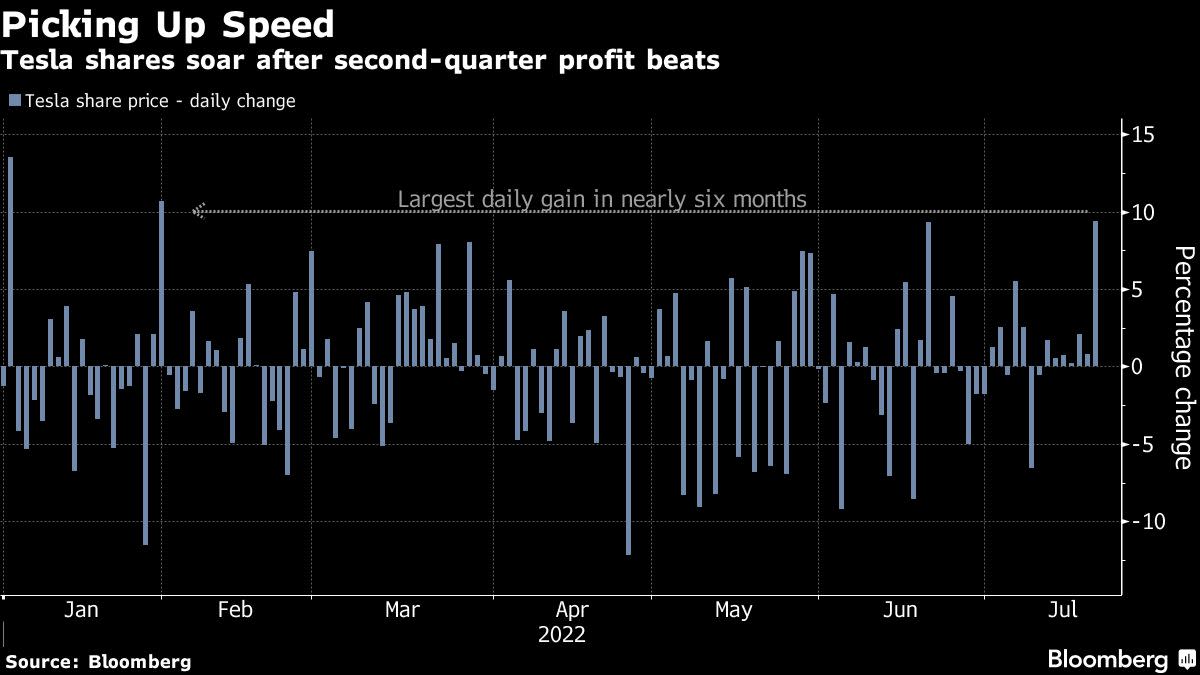

GM, which wasn’t listed on Apple’s slide, already will get income of $2 billion per 12 months from in-car subscriptions and expects it to develop to $25 billion per 12 months by 2030. Tesla, which does not assist CarPlay, lately shifted into promoting its “FSD” driver-assistance options, together with auto-parking and lane-keeping, as a subscription that prices as a lot $199 per thirty days.

Automakers in China are beginning to create electrical automobiles that combine deeply with their apps, permitting drivers to get repairs, join with different homeowners, and even get their rented batteries changed.

“We imagine this might finally result in Apple offering providers leveraging automotive sensor platforms,” Goldman Sachs analyst Rod Corridor wrote in June concerning the next-generation CarPlay.

The subsequent technology of CarPlay will want important buy-in from automakers to offer Apple’s software program entry to core programs. Apple advised it secured cooperation from a number of main carmakers.

“Automakers world wide are excited to convey this new model of CarPlay to clients,” Schubert added earlier than displaying a slide with 14 carmaker manufacturers, together with Ford, Mercedes-Benz and Audi.

Trade observers imagine carmakers have to embrace software program providers — and take a look at Apple’s providing with skepticism — or danger getting left behind.

“It is a actually tough time within the trade, the place the automotive corporations suppose they’re nonetheless constructing automobiles. They are not. They’re constructing software program on wheels, and they do not know it, and so they’re buying and selling it away,” mentioned Conrad Layson, senior analyst at AutoForecast Options.

CarPlay may generate new income

The brand new model of CarPlay could possibly be an enormous rising income engine for Apple.

First, if a person loves the iPhone’s CarPlay interface, then they’re much less prone to swap to an Android telephone. That is a strategic precedence for Apple, which generates nearly all of its income by means of {hardware} gross sales.

Second, whereas the corporate would not but cost a price to automakers or suppliers, it may promote providers for automobiles the identical manner it distributes iPhone software program.

In June, Apple revealed that it has explored options that combine commerce into the automotive’s cockpit. One new characteristic introduced this summer time would permit CarPlay customers to navigate to a fuel pump and pay for the gas from the dashboard of the automotive, in response to Reuters.

Apple already generates tens of billions from the App Retailer, and stands to spice up that if it ever decides to cost for providers in automobiles.

In 2021, for instance, Apple grossed between $70 billion and $85 billion in whole gross sales from its App Retailer — of which it takes between 15% and 30%, relying on the app. Apple would not presently take a proportion of purchases made on iPhone apps for bodily items or providers.

The brand new CarPlay additionally permits Apple to gather high-level information and knowledge about how folks use their automobiles. That is priceless info if it ever finally ends up releasing its personal automotive, which has been beneath extremely secretive growth for years. (Apple’s automotive group and its CarPlay crew are organized in separate divisions.)

For instance, when folks use Apple’s Maps app, the corporate good points perception into which routes are hottest and when site visitors is highest. It is also ready to see which CarPlay apps are gaining traction and downloads.

In a observe earlier this 12 months, Morgan Stanley analysts surmised advances in self-driving may unlock trillions of hours per 12 months that Apple may deal with with new providers and merchandise — a probably monumental market.

“What’s an hour of human time price in a automotive with nothing to do? Relies upon who you ask… however (and that is simply our view) 1.2 trillion hours instances something is A VERY LARGE NUMBER,” Morgan Stanley analysts wrote earlier this 12 months.

Automotive corporations appear skeptical

Apple says heavy hitters like Honda, Nissan and Renault are “excited” to assist the brand new CarPlay. The 14 manufacturers represented on Apple’s slide delivered greater than 17 million automobiles in 2021.

However automotive corporations won’t be as excited as Apple advised. Few of them have introduced fashions that can assist the brand new CarPlay and most are noncommittal.

Land Rover, which appeared on Apple’s slide, is “working with Apple” to see the way it could possibly be “a part of” its infotainment system, a spokesperson mentioned. “It’s too early to touch upon future product choices,” the Land Rover and Jaguar spokesperson added.

Mercedes-Benz described its dedication to CarPlay as “discussions” with Apple.

“Basically, we consider all probably related new applied sciences and features internally,” a Mercedes Benz spokesperson mentioned.

The shortage of dedication from automakers could also be a timing and product cycle concern: Apple says that automobiles will begin to be introduced “late subsequent 12 months.” However the cool response is also as a result of the brand new CarPlay represents a significant shift in Apple’s relationship with automobiles.

The brand new CarPlay would require the automotive’s real-time programs to cross that info again to the person’s iPhone, the place it is going to be analyzed and built-in into Apple’s personal software program and rendered on the automotive’s screens. Apple’s interface may also embrace automobile controls. Customers can faucet an Apple-designed touch-screen button to show up the air con, in response to Apple’s promotional video.

“Gaining management of those root features is notable as a result of it successfully shifts the in-car expertise from the palms of the carmaker over to Apple,” Loup Funds founder Gene Munster wrote in a analysis observe.

Whether or not carmakers will quit that management over the in-car expertise could possibly be strategically vital for the auto trade. Savvy digital-first electrical automotive makers equivalent to Tesla and Rivian have eschewed Apple CarPlay, over the protests of their customers, almost definitely for strategic causes (though Apple CEO Tim Prepare dinner reportedly took a journey in a Rivian truck earlier this month.)

If in-car computer systems and screens find yourself primarily displaying Apple’s interface, then automakers could have much less skill to promote these providers to their clients. They usually may lose the flexibility to outline their buyer relationship with on-line providers and apps.

“The purpose of the sport needs to be for the OEMs: ‘I will need to have a seat on the desk someplace such that when these providers are available, I’ve a finger within the pie,” Radio Free Cell analyst Richard Windsor mentioned. “With the intention to do this, the person’s smartphone has to stay in his pocket when he will get within the automobile. The minute he activates CarPlay, or Android Auto, or Android Automotive, or anything, the carmaker is in actual hassle.”

[ad_2]

Source link