[ad_1]

By now, everyone knows the litany of market woes and headwinds: inflation, which has been grabbing all of the headlines; the Fed’s flip to charge hikes and financial tightening in response to inflation; the continued record of interconnected points, together with provide chain tangles, the Russia-Ukraine battle, excessive oil costs.

Current information and market stats have solely strengthened the short-term gloom. Q1 confirmed a GDP decline of 1.6%, and preliminary information reveals the same decline for Q2, which might put the US right into a recession. However do the present clouded situations imply that traders have to totally again away from the bulls?

Weighing in from Oppenheimer, chief funding strategist John Stoltzfus doesn’t again away from making an attempt to sq. that circle. Acknowledging and analyzing in the present day’s market atmosphere, Stoltzfus confronts it head on, writing, “Even within the face of uncertainty and palpable dangers of recession, our longer-term outlook for the U.S. financial system and the inventory market stays decidedly bullish. We consider U.S. financial fundamentals stay on strong footing. U.S. development ought to stay effectively supported by client, funding and authorities spending.”

Taking Stoltzfus’ outlook and turning it into concrete suggestions, the professionals at Oppenheimer are giving two shares a thumbs up. In reality, the agency’s analysts see over 50% upside potential in retailer for every. We used TipRanks’ database to seek out out what the remainder of the Avenue has to say.

Vertex Power (VTNR)

First up is Vertex, a transitional vitality firm with a concentrate on the manufacturing and distribution of each standard and various fuels. The corporate owns roughly 3.2 million barrels value of storage capability, in addition to an oil refinery in Cell, Alabama able to producing 91,000 barrels per day of refined gas. Vertex is a key provider of base oils for the North American lubricant business, and is likely one of the largest processors of used motor oil within the US market.

The Cell refining facility is likely one of the keys to understanding Vertex Power’s present place. The corporate bought the refinery from Shell Oil, in a transaction that was accomplished in April of this yr. Vertex paid $75 million in money plus $25 million in different capital expenditures. Together with the refinery, Vertex obtained a hydrocarbon stock value $165 million, financed in a separate settlement. This acquisition is a significant advance in Vertex’s refining capabilities, and places the corporate in place to begin renewable diesel gas manufacturing in 1Q23. The Cell refinery maintained regular operations by way of the late winter and early spring, whereas the switch of possession was progressing.

Additionally within the first quarter of this yr, Vertex noticed its high line income develop year-over-year, from $25.05 million to $40.22 million, a acquire of 60%. Earnings, nonetheless, slipped, from a 1-cent acquire per diluted share within the year-ago quarter to an 8-cent loss within the 1Q22 report. Regardless of the loss, Vertex was in a position to improve its money holdings year-over-year by roughly an element of 10, from $12.52 million to $124.54 million.

In a single different extremely optimistic announcement made in current weeks, Vertex in June entered the Russell 3000 inventory index.

Noah Kaye, a 5-star analyst with Oppenheimer, sees the whole lot going proper for Vertex at this second, and writes of the corporate: “Vertex is presently experiencing a ‘blue-sky state of affairs’ on the Cell acquisition. The corporate is endeavor a relatively low-cost renewable diesel capital challenge at Cell whereas aspiring to proceed producing primarily standard fuels. Whereas attentive to execution danger and unfold compression, and seeing questions across the platform’s strategic future, we anticipate a step-change in profitability to allow flexibility for Vertex’s future development.”

Viewing this inventory as an engine for development going ahead, Kaye charges it an Outperform (i.e. Purchase), and units a value goal of $18 to recommend a one-year upside of ~52%. (To look at Kaye’s monitor document, click on right here)

General, it’s clear from the unanimous Robust Purchase consensus that Wall Avenue likes what it sees in VTNR. The inventory is presently buying and selling for $11.87 and its $22.50 common goal implies ~90% upside potential from that stage. (See VTNR inventory forecast on TipRanks)

Lumos Pharma (LUMO)

We’ll shift our focus now to the biopharma sector, the place Lumos is engaged on new therapies for uncommon ailments, by way of safer and simpler orally dosed development hormone stimulation therapies. The corporate’s lone drug candidate, LUM-201, is below investigation in scientific trials as a therapy for pediatric development hormone deficiency (PGHD), a severe situation that may result in issues in grownup life. Present therapies for PGHD contain frequent injections over a span of years; Lumos’s orally dosed possibility, if it receives approval from the FDA, will characterize a brand new various for sufferers.

Presently, LUM-201 is present process a number of human scientific trials, evaluating its potential. The main trial, the Section 2 OraGrowtH210 examine, has reportedly reached the 50% randomization milestone. Interim evaluation of this trial is predicted earlier than the top of this yr, with major final result information anticipated for launch in 2H23. The opposite superior trials, the PK/PD trial, or OraGrowtH212, is predicted to indicate interim information evaluation later this yr.

Two different trials are at earlier levels. OraGrowth211 is a proposed long-term extension of this trial collection, and the OraGrowtH213 trial is a change examine which has been initiated to judge shifting LUM-201 sufferers from the rhGH arm of the OraGrowtH210 examine.

Altogether, the info from these research satisfied the FDA in Could to elevate a partial scientific maintain which had been imposed on Lumos’s trial program. The maintain was put in place final summer time, and restricted the scientific trials to a 12-month period. With it lifted, Lumos will have the ability to performed extra prolonged research, and to provoke new, longer-term scientific trials of LUM-201. The corporate has plans to conduct the OraGrowtH210 examine over a time period of 24 months, and to increase period of the OraGrowtH212 examine.

All in all, this firm’s place, with a strong drug candidate prospect in a subject with a excessive medical want, prompted Oppenheimer’s Leland Gershell to provoke his protection of the inventory with an Outperform (i.e. Purchase) ranking.

Backing his stance, Gershell wrote, “LUMO is positioned to remodel the therapy panorama for problems stemming from development hormone deficiency (GHD) by way of the potential introduction of a day by day oral treatment… We stay up for a Section 2 interim evaluation in addition to PK/PD information as key catalysts towards year-end, for which sources present ample runway. With shares buying and selling at ~money ranges, we advocate traders construct a place.”

Trying ahead, Gershell units a $20 value goal on LUMO shares, implying an upside of 172% on the one-year time-frame. (To look at Gershell’s monitor document, click on right here)

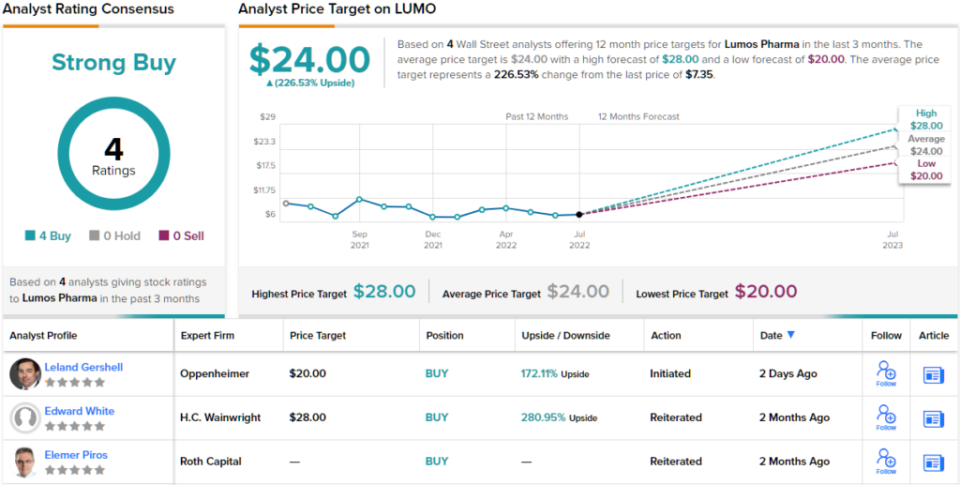

The unanimous Robust Purchase consensus ranking on this biopharma inventory relies on 4 current optimistic analyst opinions. LUMO is buying and selling for $7.35 and its $24 common value goal signifies room for a strong 226% acquire from present ranges. (See Lumos inventory forecast on TipRanks)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.

[ad_2]

Source link