[ad_1]

The European Central Financial institution has shocked markets with a bigger-than-expected rate of interest rise that brings to an finish the bloc’s lengthy experiment with unfavorable charges.

The central financial institution raised charges by 50 foundation factors to 0pc – its greatest rise since 2000 – overriding its earlier steerage of a extra cautious 25 basis-point enhance.

It additionally hinted at additional rate of interest rises at future conferences, though it gave no steerage on the dimensions of these will increase.

The euro climbed as a lot as 0.8pc towards the greenback following the shock choice.

The aggressive strategy comes as ECB officers grapple with inflation that’s surged to greater than 4 occasions its 2pc goal.

A latest hunch within the euro, which dropped to parity with the greenback, additionally boosts inflation and provides to the case for a much bigger rise, even when that hurts financial progress.

The ECB additionally unveiled a brand new device, dubbed the Transmission Safety Instrument, geared toward calming turmoil within the bond market amid issues about one other eurozone debt disaster.

It comes hours after Italian Prime Minister Mario Draghi handed in his resignation, sparking a contemporary wave of political chaos throughout the bloc.

03:17 PM

Amazon pushes additional into well being with $3.5bn One Medical deal

Amazon has snapped up major care agency One Medical in a $3.49bn (£2.9bn) because the tech big pushes additional into healthcare.

The all-cash deal marks a dramatic growth of Amazon’s healthcare ambitions and provides brick-and-mortar medical doctors’ places of work to its portfolio.

One Medical is a care supplier that provides each phone well being providers and choices to fulfill medical doctors in particular person at its 182 places of work, that are scattered throughout 25 markets within the US.

Its prospects embrace Airbnb and Google, in keeping with its web site.

Neil Lindsay, senior vice chairman of Amazon Well being Providers, mentioned: “We predict healthcare is excessive on the listing of experiences that want reinvention.”

03:01 PM

UK’s greatest fuel storage website to reopen by autumn

After the reopening of the Nord Stream pipeline this morning, there’s one other little bit of relieving information for power markets.

Rachel Millard explains:

Britain’s largest fuel storage website is a step nearer to reopening after regulators authorized a brand new licence, boosting Western efforts to chop reliance on Russian fuel.

Centrica has been authorized by the North Sea Transition Authority to retailer fuel on the Tough storage website off the coast of Yorkshire, 5 years after closing it down as a result of it was uneconomic.

There are hopes the power could possibly be reopened as quickly as this autumn, however ministers are nonetheless in talks with Centrica about doable monetary assist to assist it reopen. That would see a levy added to client payments, deepening the price of dwelling disaster.

Efforts to reopen the positioning come amid concern over fuel provides this winter as Russia restricts flows to Europe.

The EU yesterday advised member states to chop their fuel demand by 15pc in a bid to keep away from rationing and blackouts this winter.

Moscow restarted flows by the Nordstream 1 pipeline on Thursday after a shutdown for upkeep, dismissing fears that it could not restart.

The newest figures confirmed Russian fuel was flowing to Germany at about 40pc of capability between 7am and 8am, roughly the identical as earlier than the upkeep work started.

Learn Rachel’s full story right here

02:52 PM

Wall Avenue falls after ECB choice

In the meantime, the ECB’s large rate of interest rise is weighing on Wall Avenue.

The benchmark S&P 500 fell 0.2pc – its first decline in three days – whereas the Dow Jones shed 0.5pc. The tech-heavy Nasdaq was the one one to buck the development, ticking up 0.1pc.

Merchants shall be weighing up the impression of the rate of interest rise on financial progress, in addition to the ECB’s prospects for staving off one other debt disaster – particularly as Italy is plunged into political turmoil.

02:48 PM

Response: Ahead steerage is useless in Europe

Charles Hepworth, funding director at GAM, says the ECB could must deploy its new anti-fragmentation device quickly.

The final time ECB Governor Lagarde gave ahead steerage to the markets, she mentioned 0.25pc hike can be applicable in July.

Nevertheless it appears ahead steerage is now useless in Europe, simply because it now could be within the US, because the ECB shocked with a price rise of 0.5pc to deliver an finish to the unfavorable price atmosphere that has been in place since 2014.

That is the primary price hike in 11 years, because it lastly addresses the inflation dynamic throughout the Eurozone.

As a part of the triage coverage towards a fragmenting bond market, the ECB introduced a brand new antifragmentation device – the Transmission Safety Instrument.

This will effectively must be deployed quickly given the course of journey in Italian bonds proper now following PM Draghi’s resignation this morning.

European bonds are predictably shifting larger in yields throughout the curves with the Euro catching extra of a bid, however the actual motion is in Italian debt with the ten 12 months yield rising 0.2pc to three.57pc – that’s 2.2pc larger than German equal debt and now yields greater than Greece. Fragmentation?

02:46 PM

That is a wrap

That is it people, Christine Lagarde brings the press convention to an finish.

We cannot be listening to from her once more in an official capability till September’s assembly.

02:44 PM

Lagarde welcomes ‘historic’ second

Christine Lagarde is requested if this can be a historic second, and she or he agrees.

She says it is it is a gratifying second for her personally because of the unanimous backing for immediately’s motion.

The ECB chief provides that it will make it simple to speak.

02:40 PM

ECB ‘would somewhat not use’ new device

Here is some nice equivocation from Christine Lagarde.

She says the ECB would “somewhat not use” its new emergency device however “will not hesitate” if it has to take action.

A few of her colleagues have beforehand mentioned the very existence of the device means it will not need to be use, because it instills a lot confidence.

02:31 PM

Lagarde shrugs off questions on Italy

Unsurprisingly, the ECB boss is getting quite a lot of questions on Italy after Mario Draghi handed in his resignation this morning.

They don’t seem to be getting very far, although, with Ms Lagarde merely saying that the central financial institution does not take a stance on political issues.

02:28 PM

Lagarde: ECB ‘very attentive’ to power disaster

Christine Lagarde has mentioned the ECB is “very attentive” to surging fuel costs and the broader power disaster gripping Europe.

She insists that the baseline case is for no recession within the eurozone this 12 months. However she provides: “Is the outlook clouded? In fact it’s.”

02:18 PM

Euro positive factors backpedal

The euro’s positive factors have been all however worn out.

After gaining as a lot as 0.8pc towards the greenback within the aftermath of the rate of interest choice, the widespread forex has pared again its gained to simply 0.2pc.

That means markets are lower than satisfied by the ECB’s efforts to sort out the widening hole between bond yields throughout the bloc.

02:13 PM

Lagarde: Ahead steerage ‘not relevant’

It appears the ECB has thrown out all its steerage.

The central financial institution beforehand mentioned it could increase charges by 25 foundation factors at this assembly and by 50 foundation factors in September. Clearly, it hasn’t caught to that.

Requested about what this implies for the subsequent assembly, Christine Lagarde says the prior steerage on September not applies.

As a substitute, the ECB will take choice on a meeting-by-meeting foundation.

She clarifies that this does not imply the final word finish level has modified… it is nearly how shortly the ECB will get there.

02:11 PM

When will the TPI be used?

Christine Lagarde is giving a bit extra element on the so-called Transmission Safety Instrument, which is designed to forestall chaos in bond markets.

She says TPI is a programme that’s designed to handle a selected threat that each one eurozone nations can face – i.e. an enormous unfold in bond yields.

All nations are due to this fact eligible, however Ms Lagarde says the Governing Council will use its discretion for activating it the place there are “unwarranted, disorderly” bond market dynamics.

02:04 PM

ECB ‘unanimous’ on emergency device

Christine Lagarde says the ECB’s choice on its new emergency device was unanimous.

That is a victory for the central financial institution chief in securing a brand new technique to stem off one other eurozone bond disaster.

She provides that this device allowed the Governing Council to choose for a bigger rate of interest rise. That is as a result of it ought to assist to cushion the impression of upper borrowing prices on bond yields throughout the bloc.

02:00 PM

Lagarde: Inflation dangers have intensified

Christine Lagarde says that the dangers to inflation throughout the eurozone economic system have intensified – particularly within the brief time period.

She says value pressures are spreading throughout extra sectors, and inflation is predicted to stay “undesirably excessive for a while”.

The ECB chief warns indicators of upper inflation expectations want monitoring and factors to the weak point within the euro as a menace.

Nonetheless, Ms Lagarde says easing provide troubles and power costs ought to assist deliver inflation again to its 2pc goal in the long run.

01:56 PM

Christine Lagarde offers press convention

ECB President Christine Lagarde has taken to the stage for a press convention after the massive rate of interest choice.

01:52 PM

Response: Too little, too late?

Hinesh Patel at Quilter Traders is equally sceptical in regards to the ECB’s actions.

The European Central Financial institution has in the end joined the speed hike membership with this afternoon’s 50 basis-point enhance – the primary ECB rate of interest rise for 11 years.

Nonetheless, the ECB is pushing on a string with price hikes that may do little to quell what’s predominantly an power disaster. The ECB has waited far too lengthy relative to the Fed and the Financial institution of England, thereby creating further stress on the EUR which is including to inflationary stress.

The stall in industrial exercise signifies that this price hike is more likely to have minimal impression. Headline inflation is now creeping into core which shall be gravely regarding to the ECB, particularly as prices now characterize essentially the most urgent downside for corporates within the area – significantly for the likes of Italy.

Inflation is a serious subject and shall be for a while but and the balancing act confronted by the ECB stays a tough one. The bloc is confronted with inflationary shock mixed with ongoing uncertainty pushed by the warfare in Ukraine, however the ECB’s earlier inaction means immediately’s price hike may effectively be too little too late.

01:49 PM

Response: No central financial institution is in a worse place than the ECB

Seema Shah at Principal World Traders offers this damning evaluation of the ECB’s strategy to financial coverage up to now.

The ECB’s period of unfavorable charges has lastly come to an finish, and with fairly a bang – nevertheless it’s not towards a backdrop of sturdy financial progress and positively not accompanied by celebratory smiles. Fairly the opposite.

The ECB is mountain climbing right into a drastically slowing economic system, dealing with a extreme stagflationary shock that’s fairly past its management, whereas additionally dealing with an Italian political disaster which presents a tough sovereign threat dilemma.

There isn’t a different developed market Central Financial institution in a worse place than the ECB.

01:43 PM

ECB unveils new emergency device

The ECB has confirmed its approval of a brand new emergency device, which it is calling the Transmission Safety Instrument.

We’ll be listening out for extra particulars on this after we hear from Christine Lagarde, nevertheless it’s designed to curb the hole between bond yields in several EU nations as borrowing prices rise.

Italian bond yields prolonged their rise following the choice, with the 10-year yield final up 20 foundation factors on the day to three.7pc – the very best since June 28.

The closely-watched unfold to German friends widened briefly to 239 foundation factors, however was final again to pre-decision ranges close to 235 foundation factors.

01:39 PM

ECB: Additional price rises to return

Here is the central financial institution’s personal clarification of immediately’s choice:

The frontloading immediately of the exit from unfavorable rates of interest permits the Governing Council to make a transition to a meeting-by-meeting strategy to rate of interest choices.

There isn’t any element about how large these future enhance shall be, nevertheless.

01:37 PM

Response: R.I.P ahead steerage

It appears the ECB is dealing with the identical criticism that is dogged the Financial institution of England in latest months.

Frederik Ducrozet at Pictet Wealth Administration tweets laconically: “R.I.P ahead steerage.”

It is a dig at President Christine Lagarde, who beforehand advised that charges would rise by simply 25 foundation factors immediately, with an extra leap pencilled in for September.

Mr Ducrozet provides that the ECB must protect its credibility. That is one thing we have heard mentioned in regards to the Financial institution of England lots just lately, too…

01:31 PM

Cash markets guess on greater enhance in September

Cash markets are betting on 60 foundation factors of rate of interest rises on the ECB’s subsequent assembly in September. That is up from underneath 50 foundation factors earlier than immediately’s choice.

The repricing suggests buyers assume the ECB should get extra aggressive to cope with sky-high inflation, which is greater than 4 occasions over the 2pc goal.

01:30 PM

ECB joins price hike membership

The ECB’s choice marks the primary time it is moved out of unfavorable territory and the most important leap since 2000.

The choice highlights urgency amongst coverage makers to sort out surging inflation throughout the bloc, which is being fuelled partly by the escalating power disaster.

However there’s criticism that the ECB has acted too late. Even immediately’s double price rise lags behind the Federal Reserve’s latest 75 basis-point rise.

The speed on the ECB’s primary refinancing operations climbed to 0.5pc and on its marginal lending facility to 0.75pc.

When it comes to ahead steerage, the ECB mentioned future price hikes “shall be applicable”, whereas the dimensions of the strikes can be “data-dependent”.

01:27 PM

Euro spikes as ECB unveils big price hike

The euro has hit contemporary highs as merchants responded to the ECB’s surprisingly aggressive rate of interest rise.

The widespread forex rose 0.6pc towards the greenback to 1.0247 because the central financial institution dragged the bloc out of its period of unfavorable charges.

01:05 PM

HSBC agrees deal to promote Russia enterprise to Expobank

HSBC has reportedly agreed a deal to promote its Russian operations to Expobank, securing the sale shortly earlier than Moscow mentioned it could block such transactions.

A spokesman advised Reuters: “Following a strategic assessment, HSBC has signed an settlement to promote 100pc of its taking part pursuits in HSBC Financial institution (RR) LLC to Expobank JSC.”

Completion of the deal would characterize HSBC’s formal exit from Russia however the financial institution mentioned the transaction was nonetheless topic to regulatory approvals in Russia.

It comes after deputy finance minister Alexei Moiseev mentioned the Kremlin would block the sale of overseas banks’ Russian companies whereas Russian banks overseas had been additionally unable to operate usually. It’s unclear whether or not this coverage may but scupper HSBC’s plans.

12:52 PM

Power agency SSE will get windy climate increase

Power big SSE has reported higher than anticipated efficiency after larger wind speeds boosted output of its turbine farms, writes Rachel Millard.

The FTSE 100 firm mentioned its renewables output was round 5pc larger than anticipated within the three months to the tip of June “primarily on account of climate situations.”

SSE co-owns and runs the Beatrice wind farms off the Caithness coast, in addition to Better Gabbard off the coast of Suffolk. It is usually constructing a number of new websites together with Dogger Financial institution off the north-east coast, set to be the world’s largest wind farm.

In a buying and selling assertion this morning, SSE mentioned the output of its wind farms and hydropower station rose from 1,722 gigawatt-hours in April-June 2021 to 2,129 gigawatt-hours in the identical interval this 12 months.

“Efficiency has barely exceeded our expectations and additional demonstrates the energy and stability supplied by SSE’s balanced mixture of regulated and market-facing companies,” bosses added.

12:17 PM

Rishi Sunak ‘does not plan revenue tax cuts earlier than autumn 2023’

Rishi Sunak is claimed to have dismissed the thought of chopping revenue tax earlier than subsequent autumn 2023 on the earliest if he is chosen as the subsequent prime minister.

The previous Chancellor has repeatedly mentioned he would not minimize taxes till inflation is underneath management. His conclusion – based mostly on Treasury evaluation – is that that gained’t occur on a constant foundation till the center of subsequent 12 months, Bloomberg experiences.

Based mostly on the standard timing of Funds statements and the April-April tax 12 months, Mr Sunak’s place may imply any adjustments won’t take impact till Spring 2024, although a quicker timeframe isn’t unattainable.

It is a dangerous tactic for the management hopeful and contrasts starkly with Liz Truss, who has made about £34bn of tax cuts the central pledge of her marketing campaign.

12:09 PM

US futures slip as markets brace for ECB deicion

US futures slipped this morning as markets brace for the primary ECB rate of interest rise in additional than a decade.

Shares initially pushed larger as Russia resumed fuel flows by the Nord Stream pipeline, however sentiment turned unfavorable as merchants seemed forward to the ECB assembly.

There’ll even be a deal with the ECB’s promised disaster administration device as widening bond yields spark fears of one other eurozone debt disaster.

Futures monitoring the S&P 500 dipped 0.2pc, whereas the Dow Jones shed 0.3pc. The tech-heavy Nasdaq was little modified.

12:02 PM

Zara proprietor sees actual property fortune rise to $16bn

The billionaire Spaniard behind the Zara style chain has seen his actual property fortune surge over the past 12 months.

Amancio Ortega’s household workplace loved an 8.4pc enhance within the worth of its property holdings to €15.3bn (£13bn). That is much like the worth file previous to the pandemic in 2019.

The 86-year-old Zara founder noticed his fortune get well after dividends slumped final 12 months on account of Covid. Most of Mr Ortega’s revenue comes from his 59pc stake in Zara proprietor Inditex.

Mr Ortega’s wealth has enabled him to construct one of many greatest actual property portfolios on the earth and has change into landlord to a few of the world’s largest firms, together with Amazon in Seattle.

His newest offers together with the C$1.2bn acquisition of the Royal Financial institution Plaza in Toronto and an settlement to purchase 19 Dutch, a luxurious house complicated in Manhattan.

11:50 AM

HSBC unit installs Chinese language Communist Social gathering committee

HSBC has put in a Chinese language Communist Social gathering (CCP) committee for staff in its funding banking unit within the nation amid escalating tensions between Beijing and the West.

Patrick Mulholland has the story:

The financial institution’s subsidiary HSBC Qianhai Securities was arrange in 2015 to drive growth throughout mainland China and in April the lender raised its stake within the three way partnership to 90pc, up from 51pc.

Beneath Chinese language regulation, firms are required to have CCP committees with three or extra staff who’re additionally members of the Chinese language Communist celebration appointed to roles.

They operate like a staff’ union however are additionally a manner of putting in a celebration consultant inside an organization’s high ranks, typically in a director or administration position.

HSBC is believed to be the primary overseas finance group to have a CCP committee, in a transfer more likely to have a ripple impact throughout the monetary providers business.

Learn Patrick’s full story right here

11:34 AM

Pfizer and Flynn fined £70m for overcharging NHS for epilepsy medicine

Pharmaceutical corporations Pfizer and Flynn have been fined virtually £70m after they overcharged the NHS for a life-saving epilepsy drug.

The Competitors and Markets Authority mentioned the 2 firms “abused their dominant positions” available in the market to cost unfairly excessive costs over a four-year interval.

NHS prices for the phenytoin sodium capsules jumped from £2m in 2012 to £50min 2013 after costs had been hiked. The CMA mentioned it has fined Pfizer £63m and Flynn £6.7m.

Pfizer has mentioned it should attraction.

The brand new wonderful comes after the corporations challenged the CMA’s earlier choice of an £84m penalty.

Andrea Coscelli, chief government of the CMA, mentioned:

Phenytoin is a necessary drug relied on each day by 1000’s of individuals all through the UK to forestall life-threatening epileptic seizures.

These corporations illegally exploited their dominant positions to cost the NHS extreme costs and make more cash for themselves – which means sufferers and taxpayers misplaced out.

Such behaviour won’t be tolerated, and the businesses should now face the implications of their unlawful motion.

11:11 AM

Regulators warn airways to obey guidelines amid journey chaos

The competitors and aviation regulators have warned airways they need to comply with guidelines on not overselling seats and providing compensation because the summer season vacation season is tormented by journey chaos.

The Civil Aviation Authority and Competitors and Markets Authority wrote an open letter saying the had been monitoring airline practices and passenger experiences.

They warned they’d take into account enforcement motion in the event that they noticed proof of “customers persevering with to expertise these severe issues”.

11:07 AM

Elon Musk ditches most of Tesla’s Bitcoin

Elon Musk has claimed “cryptocurrency is a sideshow” as Tesla ditched three quarters of its Bitcoin holdings and the billionaire appeared to chill on digital cash.

Matthew Area has extra:

Mr Musk, who beforehand promised Tesla would by no means promote its Bitcoin and would take the digital forex as a type of fee, carried out the sudden u-turn on a name with buyers.

“Cryptocurrency isn’t one thing we take into consideration lots,” he mentioned. “The basic objective of Tesla, and the explanation we’re doing this, which is my major motivation right here, is to have the day of sustainable power come sooner. That’s our objective.

“We’re neither right here nor there on cryptocurrency.”

The Tesla chief government mentioned the corporate had offered its place in Bitcoin on account of Covid associated shut downs in China, which pressured it to pause manufacturing at its facility in Shanghai.

Tesla offered 75pc of its cash for $936m, recording an impairment cost of round $106m. At one level, its Bitcoin holdings had been price greater than $2bn.

10:40 AM

Lengthy-running Night time Tube strikes suspended

Lengthy-running strikes on London’s Night time Tube have been suspended, providing reduction for the capital’s late-night staff and revellers.

Members of the RMT union have been taking industrial motion over weekends in a dispute over shifts.

Nick Dent, London Underground’s director of buyer operations, mentioned: “We’re happy that the RMT has suspended their industrial motion on Night time Tube providers.

“That is excellent news for London and we’ll proceed to work carefully with all our commerce unions.”

Strikes had been deliberate on Night time Tube providers on the Central, Victoria, Jubilee, Northern and Piccadilly strains every weekend till December.

TfL mentioned it has run service on the Victoria, Jubilee and Northern strains, and in addition an everyday service on the Central line, regardless of latest strikes.

10:34 AM

BT Sport and Sky ‘consulted over freelance charges’

Workers at BT Sport are mentioned to have consulted with rivals at Sky about pay charges for freelancers in a transfer that would recommend collusion between the broadcasters.

In an electronic mail from July 2018, a senior government at BT Sport, seen by the Monetary Instances, wrote: “After session with Sky Sports activities, BT Sport will enhance the each day price . . . by £10 per day to £380.”

The chief was responding to requests for larger pay from freelance EVS operators, who create slow-motion replays and voice tape packages for broadcasters.

It comes after the competitors watchdog final week into whether or not BT, IMG Media, ITV and Sky had mounted the day charges paid to freelancers, saying it had “cheap grounds” to suspect a breach of competitors regulation.

10:22 AM

Blow to M&S as high government joins Primark proprietor

A high government from Marks & Spencer is leaving to affix Primark proprietor Related British Meals.

Eoin Tonge, presently chief monetary and technique officer at M&S, will exchange John Bason as finance director at AB Meals.

Mr Bason, who has labored at AB Meals for 23 years, will change into chairman of a newly constituted strategic advisory board and a senior adviser to Primark.

The transfer is a blow to M&S as Mr Tonge was given an expanded position only some weeks in the past and billed a key a part of a high administration group of three charged with working M&S following the departure of Steve Rowe.

Mr Tonge was named chief technique officer, along with his finance position, alongside co-chief executives Stuart Machin and Katie Bickerstaffe, who solely works 4 days every week.

Shares in M&S fell 2pc following the announcement, whereas AB Meals was up 1pc.

10:14 AM

Tesla’s earnings knocked by China manufacturing facility shutdowns because it sells Bitcoin

ICYMI – Tesla has fallen sufferer to provide chain chaos in China and a harmful guess on Bitcoin, bringing a file run of earnings at Elon Musk’s automotive firm to a sudden finish.

Here is extra from Matthew Area:

The electrical automobile maker additionally offered off a piece of its Bitcoin holdings, the corporate mentioned on Wednesday, as its guess on the cryptocurrency soured.

Revenues at Tesla dropped by 9pc between the second and first quarter to $16.9bn (£14.1bn), although had been nonetheless 42pc larger than a 12 months earlier.

Its revenues had been down on the file three-month revenues of $18.8bn it posted earlier this 12 months amid provide chain woes and a manufacturing facility shut down in China on account of Covid restrictions.

Telsa mentioned it “confronted sure challenges, together with restricted manufacturing and shutdowns in Shanghai for almost all of the quarter” however claimed it “continued to make important progress throughout the enterprise in the course of the second quarter of 2022”.

Earlier this month, Tesla reported it had delivered greater than 254,000 electrical automobiles, down from round 300,000 within the earlier quarter.

Learn Matt’s full story right here

09:59 AM

Heathrow gas staff halt strike after pay supply

Refuelling staff at Heathrow have referred to as off a strike that was on account of start immediately.

The Unite union mentioned the walkout was suspended after Aviation Gasoline Providers made a “sustainably improved supply”. The roughly 50 staff concerned will now be given time to contemplate the proposal.

AFS is a three way partnership amongst gas firms that provides gas to greater than 70 airways, together with American Airways, United Airways and Emirates.

The threatened strikes had been one in all numerous disputes which have added to move chaos throughout the UK and Europe this eummer.

Earlier this month, British Airways reached an settlement with check-in staff to keep away from a strike after the provider scrapped 1000’s of flights amid a staffing disaster.

09:46 AM

Authorities used P&O Ferries regardless of condemning sackings

The Authorities has admitted P&O Ferries was utilized by the navy whilst ministers condemned the agency for sacking 800 staff with out discover.

The Division for Transport cancelled a contract with P&O after conducting a assessment of presidency enterprise with P&O within the wake of the sackings in March.

However the Ministry of Defence mentioned it used P&O to assist a latest train, the BBC experiences.

It got here after the RMT union mentioned it noticed proof the MoD had purchased slots on P&O’s Dover-Calais service.

In March, P&O changed its sacked employees with overseas company staff paid lower than the minimal wage. Its providers had been suspended and several other of the corporate’s vessels failed security inspections earlier than being cleared to renew working.

09:35 AM

Pound falls forward of Huw Capsule speech

Sterling misplaced floor towards the greenback this morning as buyers turned their consideration to the political drama and one other Financial institution of England speech.

Chief economist Huw Capsule is because of give one other speech later immediately, which shall be analysed for hints about additional rate of interest rises.

Markets can even have an in depth eye on Liz Truss and Rishi Sunak for particulars of potential polices as they go face to face within the race to change into the subsequent prime minister.

The pound fell 0.4pc towards the greenback to $1.1923. In opposition to the euro it was additionally down 0.4pc at 85.35p.

09:23 AM

Italian markets in chaos as Mario Draghi resigns

Italian markets are in chaos this morning as Prime Minister Mario Draghi handed in his resignation.

The previous ECB chief introduced his choice to President Sergio Mattarella. The federal government will proceed as a caretaker to deal with ongoing enterprise.

The collapse of Draghi’s Authorities was inevitable after three of his coalition companions withdrew their assist in a confidence vote yesterday.

Italy’s benchmark FTSE MIB index slumped greater than 2pc, led by sharp falls for banking shares. Italy’s 10-year bond yield surged 20 foundation factors to three.57pc.

09:18 AM

Go-Forward bidder drops out of £650m takeover race

An Australian bidder has dropped out of the race to snap up transport group Go-Forward – every week after the board picked a rival supply.

Kelsian mentioned falling share costs in its dwelling nation tied its arms and meant it needed to stroll away.

Kelsian is one in all Australia’s greatest bus and ferry firms; it additionally has operations in Singapore and London.

It tried to muscle in on a deal to purchase Go-Forward, which co-runs the Govia Thameslink Railway, however its shares have fallen by greater than 15pc in latest weeks.

It comes after Go-Forward reached an settlement with Australian rival Kinetic and Spain’s Globalvia. The £650m deal pays shareholders £15 for every share they personal within the firm.

Go-Forward mentioned it should go forward with the Kinetic and Globalvia deal. Shares dropped 3pc in early buying and selling to round 16p under the supply value.

09:11 AM

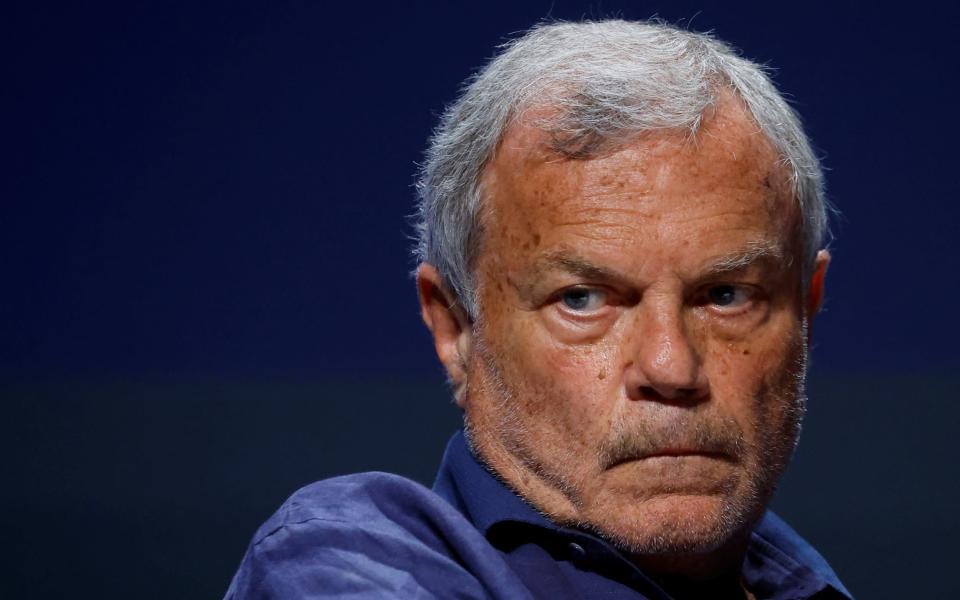

S4 Capital shares crash 50pc after revenue warning

Shares in Sir Martin Sorrell’s S4 Capital crashed this morning after the promoting agency slashed its revenue expectations for the complete 12 months.

Shares slumped as a lot as 50pc – their greatest fall on file – to achieve their lowest since 2020.

The newest collapse follows a plunge in later March after the digital advert group delayed its annual outcomes, wiping about £1.2bn off its market worth.

S4 mentioned it expects earnings earlier than curiosity, tax, depreciations and amortisation to be about £120m, effectively under analysts’ forecasts of between £154m and £165m.

The corporate blamed the diminished numbers on a pointy rising in hiring and employees prices. It added that cost-cutting measures, together with a brake on hiring, have now been launched.

08:58 AM

Mike Ashley’s Frasers Group posts leap in earnings

Mike Ashley’s Frasers Group booked a pointy rise in earnings for the complete 12 months, regardless of warning over the cost-of-living disaster and provide chain pressures.

The corporate, which owns Sports activities Direct and Home of Fraser, posted pre-tax earnings £344.8m for the 12 months to April, up from a £39.9m loss within the earlier 12 months. Income jumped 31pc to £4.75bn.

That was regardless of a “important enhance” in working prices.

Frasers additionally lifted its forecasts for the present 12 months, saying it now expects to publish a pre-tax revenue of between £450m and £500m over the present monetary 12 months.

Nonetheless, the retail big warned the cost-of-living disaster and provide chain troubles may impression its enterprise, and made contemporary requires the Authorities to overtake “a basically flawed enterprise charges system”.

08:42 AM

FTSE risers and fallers

The FTSE 100 has began the day on the again foot as the most recent public borrowing figures added to investor issues in regards to the financial outlook.

The blue-chip index fell 0.3pc, with losses for numerous staple client and pharmaceutical shares.

Ocado sank to the underside of the index after reporting a £211m loss for the primary half, however reversing course and pushing again into the inexperienced.

On a busy day for outcomes, there was constructive momentum for each Howden Joinery and 3i Group, which rose greater than 4pc and a pair of.4pc respectively.

The domestically-focused FTSE 250 rose 0.4pc, with Frasers Group leaping virtually 12pc after reporting a surge in earnings.

08:35 AM

A 3rd of households to plunge into power poverty by October

Surging power costs will push one in three UK properties into power poverty by October, in keeping with damning new predictions.

The variety of properties spending greater than 10pc of their whole revenue on power payments will leap to eight.2m that month, in keeping with the Nationwide Power Motion charity.

Payments are set to leap by about 60pc in October when the brand new value cap kicks in, and the forecasts keep in mind a £400 low cost for all customers.

The surge in power payments can be set to drive inflation to above 11pc, piling extra stress on British households.

Peter Smith, director of coverage at NEA, mentioned: “The hovering value of power, significantly for low-income and weak households, is likely one of the greatest points dealing with the nation.”

08:22 AM

Ocado losses hit £200m as cost-of-living crunch weighs

Ocado has reported a wider loss for the primary half of the 12 months because it feels the warmth from the UK’s worsening cost-of-living disaster.

Income dropped 4pc whereas pre-tax loss ballooned to £211m. Shares fell as a lot as 4.5pc to the underside of the FTSE 100.

Ocado has been hit by a pointy drop in demand at its on-line three way partnership with Marks & Spencer as customers tighten the purse strings. The common basket measurement for the corporate was £120, down 13pc on final 12 months.

Ocado Retail has slashed its forecast twice this 12 months and yesterday introduced the departure of boss Melanie Smith.

Regardless of the widening loss, Ocado reiterated its forecast for a minimum of £6.3bn in income and £750m in earnings.

08:15 AM

Gasoline costs fall as Nord Stream flows return to 40pc

Gasoline costs throughout Europe have dropped this morning after Putin restarted provides by the Nord Stream pipeline.

The newest figures confirmed Russian fuel was flowing to Germany at about 40pc of capability between 7am and 8am. That is roughly the identical as earlier than the upkeep work started.

Benchmark European fuel costs fell as a lot as 6.5pc, whereas the UK equal was down 5.3pc.

08:13 AM

Putin resumes fuel flows by Nord Stream pipeline

There’s reduction throughout power markets this morning as Putin resumed pumping fuel by the Nord Stream pipeline after a 10-day outage.

Europe has been on tenterhooks about whether or not flows would restart after deliberate upkeep on the hyperlink, which accounts for greater than a 3rd of Russia’s exports to the EU.

A spokesperson for the operator mentioned: “We’re in means of resuming fuel transportation. It might probably take few hours to achieve the nominated transport volumes.”

There’s nonetheless uncertainty over how a lot fuel shall be pumped, although. Russia final month slashed provides to 40pc of capability, sparking accusations it was utilizing power provides as a weapon.

The EU yesterday advised member states to chop their fuel demand by 15pc in a bid to keep away from rationing and blackouts this winter.

08:05 AM

Response: Borrowing overshoot will maintain again new PM

Ruth Gregory, senior UK economist at Capital Economics, says the brand new prime minister can have their work minimize out in tackling the cost-of-living disaster.

June’s public funds figures supplied extra proof that the federal government’s fiscal place is worse than the OBR predicted again in March.

This will restrict the flexibility of the subsequent prime minister to offer extra reduction for households when an extra rise in CPI inflation from 9.4pc in June to round 12pc in October worsens the price of dwelling disaster.

Meaning after three months of the 2022/23 monetary 12 months, borrowing is £3.6bn larger than the OBR anticipated at this stage. And that’s earlier than taking into consideration the online £10.3bn handout by the Chancellor in Might, a doable additional fiscal loosening within the autumn in addition to the additional upward impression on borrowing from rising rates of interest and weaker actual GDP progress coming down the road.

So whereas borrowing will most likely nonetheless fall from final 12 months’s (downwardly revised) £141.8bn, we expect will probably be nearer to £110bn in 2022/23 somewhat than the OBR’s forecast of £99bn.

This additional deterioration in borrowing in June gives a well timed reminder to the subsequent prime minister (Sunak or Truss) that the general public funds are weaker than the OBR’s forecasts recommend.

08:02 AM

FTSE 100 dips

The FTSE 100 has opened decrease this morning after borrowing figures highlighted the pressure on the general public funds.

The blue-chip index slipped 0.1pc into the crimson at 7,258 factors.

07:59 AM

What does this imply for the Tory management hopefuls?

The newest numbers spotlight the problem confronted by both Rishi Sunak or Liz Truss once they succeed Boris Johnson as prime minister.

Britain is grappling with a deepening cost-of-living disaster as costs throughout every part from meals to power payments proceed to surge. In flip, that is beginning to take its toll on the economic system.

With inflation forecast to peak above 11pc later within the 12 months, stress is mounting on the Treasury to offer extra assist to households, whereas it has been pressured into bigger-than-planned wage will increase for public sector staff.

What’s extra, Liz Truss has promised greater than £30bn of debt-funded tax cuts for staff and companies. Rishi Sunak has taken a extra cautious strategy.

Both manner, nevertheless, ballooning debt prices imply the subsequent prime minister can have much less fiscal headroom than they might have favored.

07:52 AM

Zahawi: There are dangers to public funds

Here is Chancellor Nadhim Zahawi’s response to the most recent public borrowing figures:

We recognise that there are dangers to the general public funds together with from inflation, with debt curiosity prices in June greater than double the earlier month-to-month file.

That is why the Authorities has taken motion to strengthen the general public funds, and of their newest forecast the OBR assessed that we’re on observe to get debt down.

07:51 AM

Inflation drives up finances deficit

The overshoot in public borrowing is being pushed by the surging value of dwelling, as debt funds on round 1 / 4 of all authorities bonds are linked to the retail value index.

Figures out yesterday confirmed RPI jumped to 11.8pc in June – the very best stage in 40 years.

Final month alone, curiosity prices amounted to £19.4bn. That is greater than double the earlier month-to-month file. Within the final three months they’re up 82pc in comparison with final 12 months.

Debt prices are all the time larger than regular in June because of the manner index-linked funds are calculated, and the determine is more likely to fall again in July.

Nonetheless, continued excessive inflation and rising rates of interest imply they’re more likely to overshoot the OBR’s forecast of £87bn for the 12 months as an entire.

07:46 AM

Debt prices surge in blow for subsequent PM

Good morning.

A file curiosity invoice drove the finances deficit as much as £22.9bn in June, limiting the subsequent prime minister’s fiscal firepower as borrowing for the month hit the very best stage outdoors of Covid occasions.

Debt curiosity funds, that are being pushed up by inflation on the massive inventory of index-linked authorities bonds, hit an all-time excessive of £19.4bn in worse-than-expected figures.

Economists mentioned the deterioration within the public funds would “restrict the flexibility of the subsequent PM to offer extra reduction for households”.

Nonetheless, inflation and Rishi Sunak’s raid additionally drove tax receipts £8bn larger.

5 issues to begin your day

1) Gasoline rationing won’t save Europe from a winter disaster Putin’s willingness to weaponise power provides means EU will wrestle to fill storage

2) Inexperienced power shift offers China ‘leverage’ over Britain, Lords warn Overreliance on Beijing’s crucial minerals market is a ‘nationwide safety concern’

3) Guardian editor handed inflation-busting £150,000 pay rise Katharine Viner’s base wage elevated by 42pc regardless of newspaper’s criticism of ‘profiteering bosses’

4) Robotic digital camera cope with China blocked in first use of recent nationwide safety regulation College of Manchester prevented from sharing expertise utilized in youngsters’s toys, drones and different surveillance gear

5) Gatwick hires 400 safety employees to sort out journey chaos Hiring spree goals to ease queues as college summer season holidays start

What occurred in a single day

Hong Kong shares opened barely down this morning, with the Dangle Seng Index dropping 0.4pc.

The Shanghai Composite Index eased 0.2pc whereas the Shenzhen Composite Index on China’s second trade additionally fell 0.2pc.

Tokyo shares additionally opened decrease, the benchmark Nikkei 225 index dipping 0.04pc

Arising immediately

-

Economics: Rate of interest choice (EU), GfK client confidence (UK), preliminary jobless claims (US), Philadelphia Fed Manufacturing Survey (US)

-

Company: IG Group (full-year outcomes); Howden Joinery, Moneysupermarket Group, Ocado (interims); 3i Group, AJ Bell, Anglo American, Brewin Dolphin, Britvic, Shut Brothers, Diploma, Dunelm, Euromoney Institutional Investor, Frasers Group, Intermediate Capital Group, QinetiQ, SSE, Workspace Group (buying and selling replace)

[ad_2]

Source link