[ad_1]

Dow Jones futures fell modestly early Friday, together with S&P 500 futures and Nasdaq futures, as Intuitive Surgical and particularly Snap weighed on a number of on-line giants. The inventory market rallied, with Tesla (TSLA) and decrease Treasury yields driving the Nasdaq increased.

X

There’s rising optimism that the market bottomed in mid-June. The Nasdaq might be prepared for a pullback, nonetheless, particularly with so many earnings coming subsequent week.

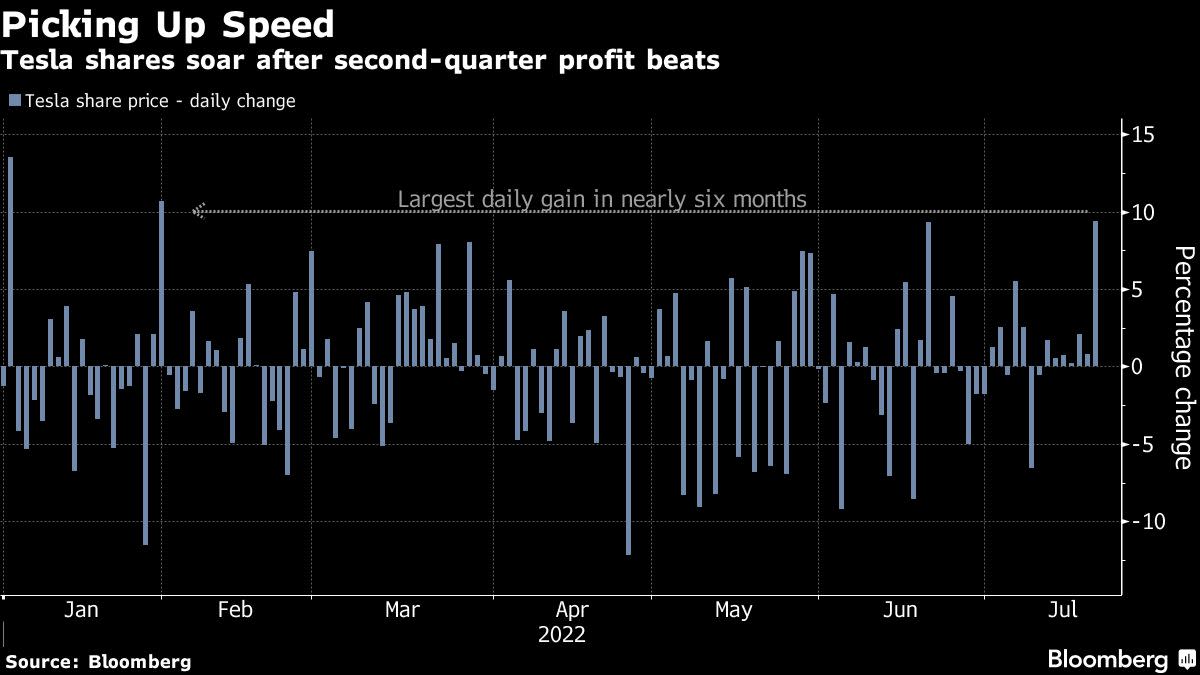

In Thursday’s session, Tesla inventory surged on earnings, blasting increased. Shares cleared an aggressive purchase space, however now look prolonged whereas nonetheless being nicely off highs.

Key Earnings Late

Snap (SNAP) and Intuitive Surgical (ISRG) plunged late Thursday on disappointing outcomes.

SNAP inventory crashed 27% in after-hours buying and selling, not removed from its mid-June backside. Shares had closed up 5.6% to 16.38. Snap reported a Q2 loss that was barely worse than anticipated, whereas income fell quick. The Snapchat guardian additionally would not provide Q3 steerage. Whereas asserting a $500 million buyback program, Snap will sluggish hiring and curb working bills. All that could be a dangerous signal for social media corporations and on-line ad-dependent corporations. Fb guardian Meta Platforms (META) misplaced almost 5% and Google guardian Alphabet (GOOGL) sank 3% forward of their earnings subsequent week. Commerce Desk (TTD) retreated 7%.

Twitter earnings are due Friday morning. TWTR inventory fell solely 2% late Thursday, with Elon Musk’s contested takeover deal offering some help.

Intuitive Surgical earnings fell for a second quarter, whereas income development slowed for a fourth straight quarter, to simply 4%. Each missed views because the robotic surgical procedure big blamed Covid’s ongoing impression on elective procedures. ISRG inventory dived 13%, set for a tumble again under its 50-day line. The Intuitive Surgical earnings and commentary might be a foul signal for different medical system, merchandise and programs makers.

Shares Close to Purchase Factors

Ulta Magnificence (ULTA), Ollie’s Cut price Outlet (OLLI), Fortinet (FTNT), Neurocrine Biosciences (NBIX) and Quanta Providers (PWR) are shares establishing.

Ollie’s Cut price Outlet and PWR inventory are on the IBD Leaderboard watchlist. OLLI inventory is on SwingTrader. FTNT inventory is on the IBD Lengthy-Time period Leaders checklist. ULTA inventory is on the IBD 50 checklist. Neurocrine Biosciences was Thursday’s IBD Inventory Of The Day.

The video embedded within the article mentioned Thursday’s market rally and analyzed Tesla inventory, Carlisle (CSL) and elf Magnificence (ELF).

Dow Jones Futures At this time

Dow Jones futures dipped 0.1% vs. truthful worth. S&P 500 futures sank 0.4%. Nasdaq 100 futures fell 0.8%. ISRG inventory is on the Nasdaq 100, together with Meta Platforms and Google inventory.

Keep in mind that in a single day motion in Dow futures and elsewhere does not essentially translate into precise buying and selling within the subsequent common inventory market session.

Be part of IBD consultants as they analyze actionable shares within the inventory market rally on IBD Dwell

Inventory Market Rally

The inventory market rally saved shifting increased, with Tesla and the Nasdaq main the best way.

The Dow Jones Industrial Common climbed 0.5% in Thursday’s inventory market buying and selling. The S&P 500 index rallied 1%, with TSLA inventory the largest gainer. The Nasdaq composite popped 1.4%. The small-cap Russell 2000 gained 0.5%.

U.S. crude oil costs fell 4.1% to $95.80 a barrel. Gasoline futures tumbled 4.9%, suggesting that retail costs on the pump will maintain falling for at the very least the following couple of weeks.

The ten-year Treasury yield tumbled 13 foundation factors to 2.91%. The 2-year Treasury yield dived 16 foundation factors to three.09%. Jobless claims rose to an eight-month excessive whereas the July Philly Fed manufacturing index confirmed exercise declining at a quicker tempo. Each increase recession fears but in addition bolster expectations that the Federal Reserve will increase charges by 75 foundation factors subsequent Wednesday, not a full level.

Among the many finest ETFs, the Innovator IBD 50 ETF (FFTY) climbed 0.4%, whereas the Innovator IBD Breakout Alternatives ETF (BOUT) additionally edged up 0.4%. The iShares Expanded Tech-Software program Sector ETF (IGV) superior 1.8%. The VanEck Vectors Semiconductor ETF (SMH) climbed 1.7%.

Reflecting more-speculative story shares, ARK Innovation ETF (ARKK) picked up 1.75% and ARK Genomics ETF (ARKG) 1.8%, including to massive positive aspects this week. Tesla inventory is a significant holding throughout Ark Make investments’s ETFs.

SPDR S&P Metals & Mining ETF (XME) edged up 0.1% and the World X U.S. Infrastructure Growth ETF (PAVE) 1.5%. U.S. World Jets ETF (JETS) descended 2.7%, with United Airways (UAL) and American Airways (AAL) hammered on Q2 outcomes. SPDR S&P Homebuilders ETF (XHB) popped 2.1%. The Power Choose SPDR ETF (XLE) skidded 1.75% and the Monetary Choose SPDR ETF (XLF) rose 0.6%. The Well being Care Choose Sector SPDR Fund (XLV) rebounded 1.6%.

5 Greatest Chinese language Shares To Watch Now

Tesla Inventory

Tesla earnings comfortably beat second-quarter views late Tuesday, with CEO Elon Musk saying the Cybertruck is on observe for mid-2023. TSLA inventory shot up 9.8% to 815.12, clearing resistance going again to early June and breaking above a trendline beginning in early April. An aggressive investor might have purchased Tesla inventory close to the open, however even then it was getting prolonged from its 50-day line. By Thursday’s shut, shares had been 14% above the 50-day. In the meantime, the EV big continues to be considerably under its 200-day line, and a great distance from its official purchase level of 1,208.10. At this level, traders might wish to see TSLA inventory decisively retake the 200-day line after which kind a deal with, whereas letting the main averages catch up.

After the shut, Bloomberg reported that Tesla is anticipated to oust Omead Afshar, a high Musk lieutenant who’s working the Texas manufacturing unit. Tesla’s inside auditors are reportedly probing Afshar involving purchases of suspicious development supplies, together with a particular form of glass. A number of Tesla workers have already been fired within the investigation.

TSLA inventory edged decrease in a single day.

Shares To Watch

Ulta Magnificence inventory edged up 0.7% to 411.27 on Thursday. Shares have a 429.58 purchase level from a flat base subsequent to a collection of failed consolidations going again to final August. However traders might use Wednesday’s excessive of 412.50 as a short-term entry. ULTA inventory is 5.2% above its 50-day line, which isn’t too prolonged. Ulta is one of some magnificence shares shaping up, regardless of not-quite-picture-perfect charts.

Ollie’s inventory dipped 1.2% to 66.50 on Thursday, however bounced considerably from its 21-day shifting line. That gives an aggressive entry or follow-on shopping for alternative into the closeout retailer, which broke out final month from a bottoming base.

FTNT inventory climbed 3.7% to 61.86, shifting again towards its 200-day line. That is an space the place Fortinet inventory has hit resistance over the previous few months. A decisive transfer above the 200-day, maybe clearing the July 12 excessive of 63.56, would provide an early entry or a spot to begin a place on the IBD Lengthy-Time period Leaders checklist. The official FTNT inventory purchase level is 74.45 from a consolidation going again to the tip of final 12 months, however shares have been range-bound for nearly a 12 months.

PWR inventory rose 0.6% to 133.07, engaged on a 138.56 purchase level from a clumsy cup-with-handle base, in accordance with MarketSmith evaluation. Quanta Providers is slightly below an early entry of 133.68 inside that deep deal with. PWR inventory is 8.3% above its 50-day line, so an extended pause might be constructive.

NBIX inventory edged up 0.1% to 97.60. Neurocrine Biosciences has a 100.10 cup-with-handle purchase level. Shares arguably are actionable from breaking a brief trendline inside that deal with. NBIX inventory is at present 5.3% above its 50-day.

Time The Market With IBD’s ETF Market Technique

Market Rally Evaluation

The inventory market rally continued its robust current run. As soon as once more, the Nasdaq led the best way, although on Thursday the Russell 2000 was considerably of a laggard.

The Nasdaq is again above the 12,000 stage, with the early June highs not too far-off. The S&P 500 and Russell 2000, modestly above their late June highs, have some room earlier than working as much as early June peaks. The Dow continues to be buying and selling round its late June highs, however rebounded from a 50-day line check intraday.

The Nasdaq has risen considerably over the previous week, and is close to the excessive finish of a regression line. That might sign a pause or a pullback quickly.

That is one thing to remember because the market faces an avalanche of earnings. Along with Fb guardian META’s inventory and Google inventory, Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), Exxon Mobil (XOM) and Chevron (CVX) are due subsequent week, together with lots of of others. They’re going to share middle stage with the Federal Reserve assembly.

Whereas Tesla inventory soared on earnings, Snap and Intuitive Surgical are only a style of what traders would possibly see within the coming days.

There nonetheless aren’t a whole lot of nice shares to purchase. Whereas positive aspects have been broad-based, a whole lot of the large winners not too long ago have been hard-hit development shares corresponding to Datadog (DDOG), Nvidia (NVDA) and Tesla inventory. A few of the main areas, corresponding to well being insurers and discounters, have retreated this week, with sharp intraday drops in some instances.

ETFs monitoring the Nasdaq, software program, biotech and chip sectors are methods to play the uptrend proper now.

Why This IBD Device Simplifies The Search For High Shares

What To Do Now

Traders who’ve constructed up positions prior to now week are in all probability grateful for doing so. The market rally definitely appears to be a tradable rally, at the very least. With the Nasdaq working up so shortly and looking out prolonged by some measures, a pullback of some type wouldn’t be a shock. The large information on faucet implies that the market and particular person shares might see main swings.

So do not rush so as to add publicity. Proceed so as to add to your holdings fastidiously if the market and your positions maintain working, however do not be afraid to maintain taking some partial earnings shortly.

Search for early shopping for alternatives, and shares that are not too prolonged from shifting averages. In 2022, shares rising to or previous conventional purchase factors have typically struggled. Even names that proceed to work can have massive intraday shakeouts.

Work in your watchlists, emphasizing robust relative power. Give attention to shares in or close to buyable areas.

Learn The Large Image every single day to remain in sync with the market course and main shares and sectors.

Please comply with Ed Carson on Twitter at @IBD_ECarson for inventory market updates and extra.

YOU MAY ALSO LIKE:

Greatest Progress Shares To Purchase And Watch

IBD Digital: Unlock IBD’s Premium Inventory Lists, Instruments And Evaluation At this time

The 200-Day Common: The Final Line Of Assist?

Tesla Vs. BYD: Which EV Large Is The Higher Purchase?

[ad_2]

Source link